Transform your Life insurance

Despite the stalled premium growth within developed markets and depressed interest rates, the growing demand and changing demographics provide a wealthy outlook for Life Insurers. The AdInsure insurance platform empowers their path towards personalized customer experience, development of flexible products, and leveraging skills and capabilities to drive innovation.

Celent life report Book a demo

From risk to investment life products.

AdInsure provides comprehensive support for many life insurance coverages, including protection and investment products. The support includes Life Policy Administration and Claims, Sales portals for agents, and distribution partners such as Banks.

AdInsure is a future-proof investment that makes it easy to integrate emerging technologies and data that will significantly impact insurers' ability to play an active role in future areas such as client health.

Endownment

Whole life

Term life

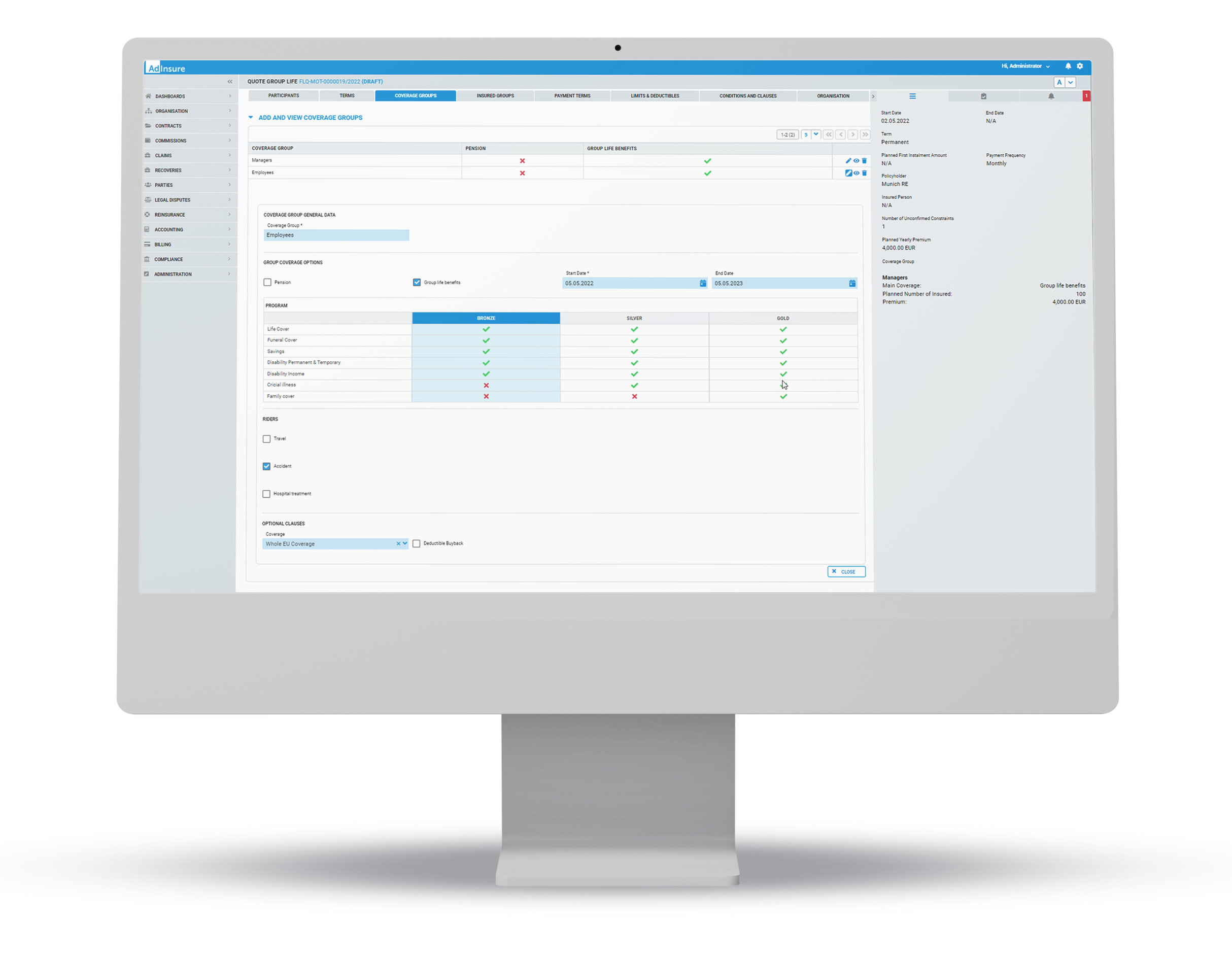

Group life

Credit risk

Unit Linked

Support for all your teams

AdInsure provides comprehensive support for all your business teams,including product management, underwriters, and sales and distribution partners.

DOWNLOAD FLYERIndividual and group insurance

Frequently asked questions

For a fast overview, here are some of the most asked questions we get about AdInsure's support for life insurance lines.

Which Life lines of business does AdInsure support out of the box?

Out of the box, AdInsure supports the following lines: Endowment, Credit risk, Term life, Group risk, whole life, universal, and Unit Linked life products. Out-of-the-box support includes the premium model, support for Quote, underwriting, policy management, Claims, and predefined forms and dashboards for B2B distribution channels.

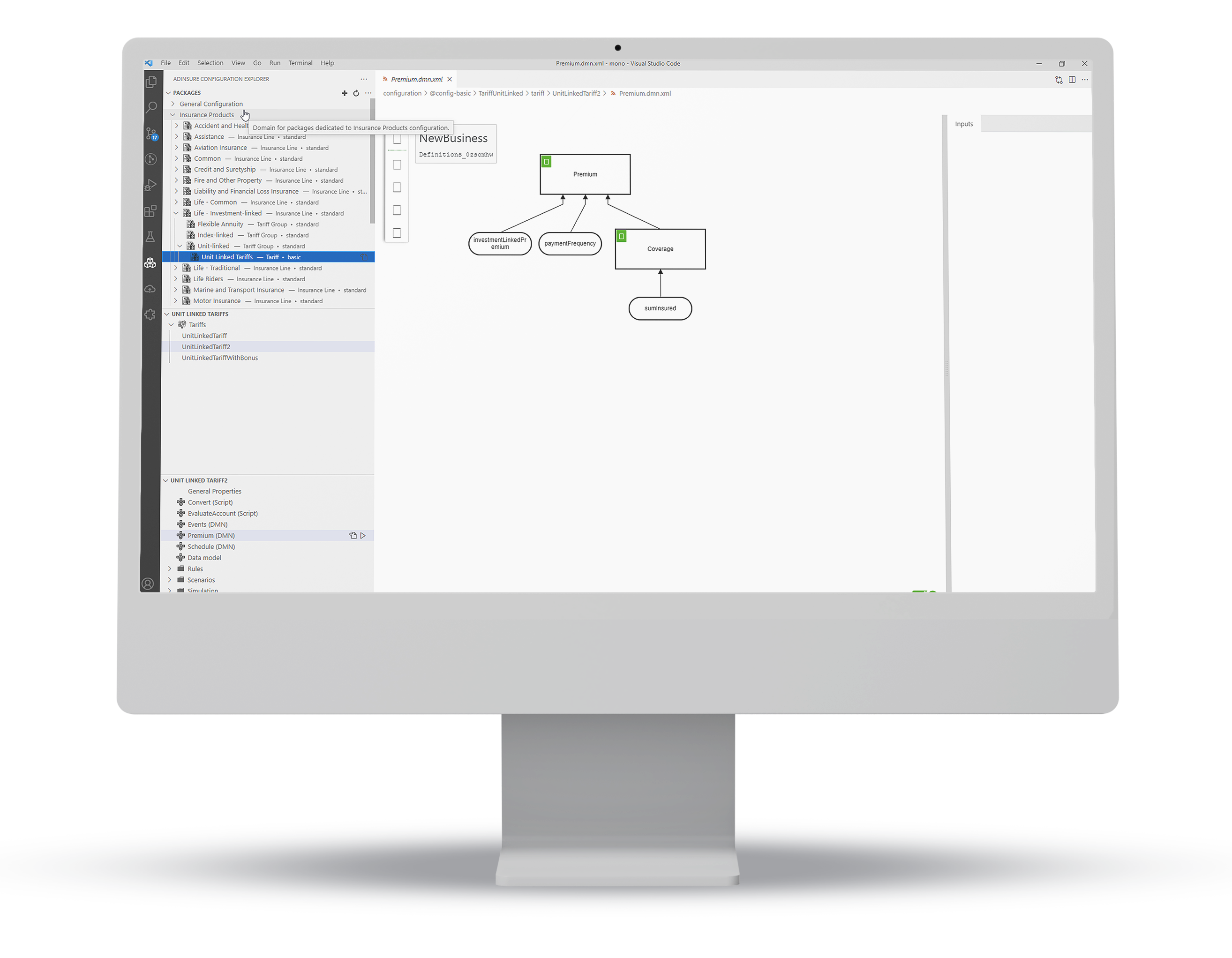

How does AdInsure support new lines of business?

New products can be easily designed and configured with the help of AdInsure Studio, leveraging the vast library of predefined configurations and Wizards that will guide you through the process.

What kind of support does AdInsure provide for Life Underwriting?

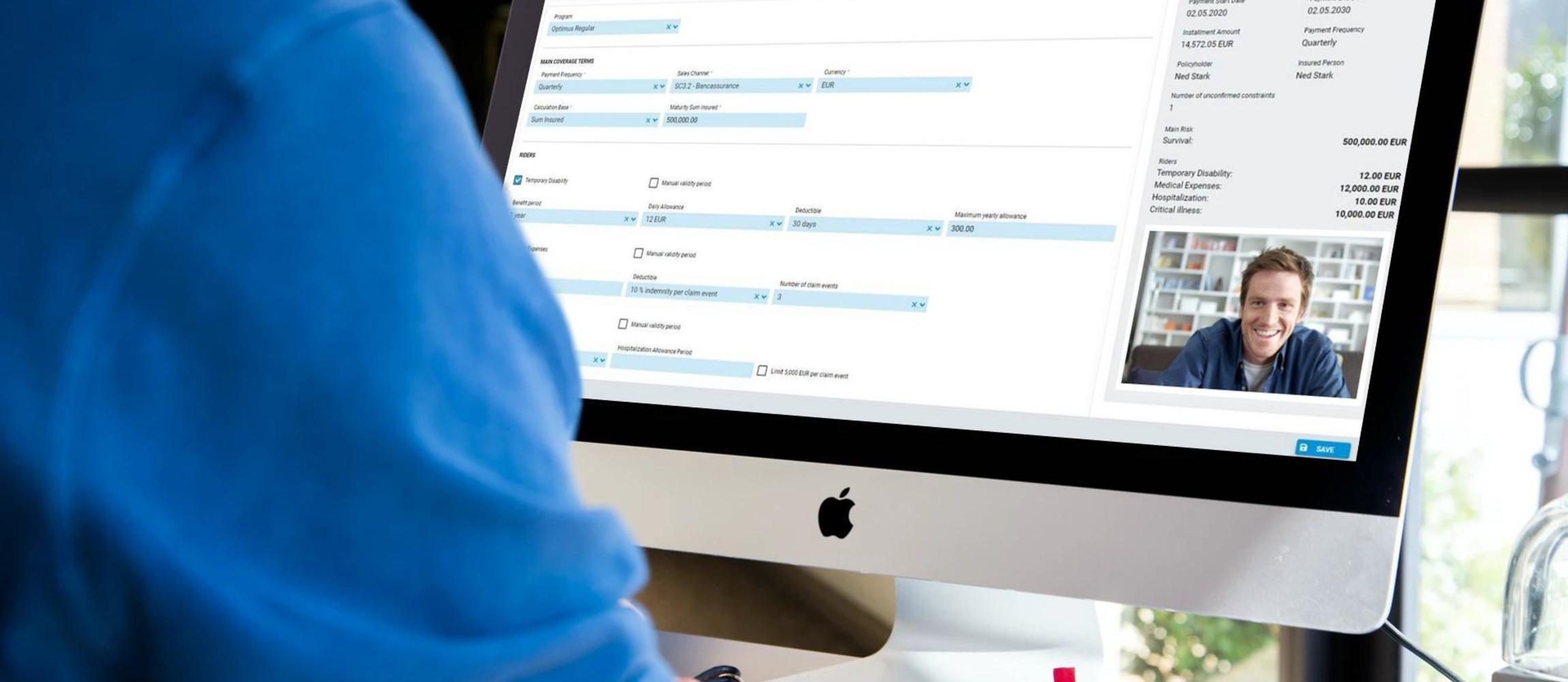

The underwriting process can be adjusted for each product separately. The UW process is easily configurable by a set of Underwriting rules that support different levels of underwriting. Underwriting features include review and rejection of Quotes, confirmation of constraints, and rejection of quotes with counteroffers. Underwriters can easily create one or more counteroffers with adjusted coverages if requested client coverage cannot be offered. Underwriters can also assign tasks and collaborate with agents via Video chat.

How does AdInsure support distribution channels?

The AdInsure Agent Portal provides everything a sales agent needs in one place, from workflows for applications, quotes, policies, and underwriting. The portal can be fully integrated with AdInsure Policy management and Claims modules or can be implemented as a standalone solution. The portal leverages custom dashboards, providing an overview of open invoices and commissions. The portal also enables the agent to collaborate with the team or clients with co-browsing and video functionality. It also provides a Customer 360- view that provides a complete overview of the Client in one place; all offers, policies, personal and billing information, even consensus.