About the Client

Client is a leading insurance-financial group in South-East Europe. The group operates in six countries, offering a comprehensive range of insurance products, including motor, property, life, health and pension, leisure and more.

The challenge

The distribution of the client's insurance products through banking channels encountered significant challenges. The sales process was fragmented and heavily reliant on manual operations, limiting efficiency and creating a disconnect between partners.

Traditional physical sales channels dominated, making it clear that an enhanced, streamlined experience was essential. To address these issues, the client recognized the need to unify banking sales operations on a single digital sales platform, simplifying processes and empowering their partners to deliver better outcomes.

The solution

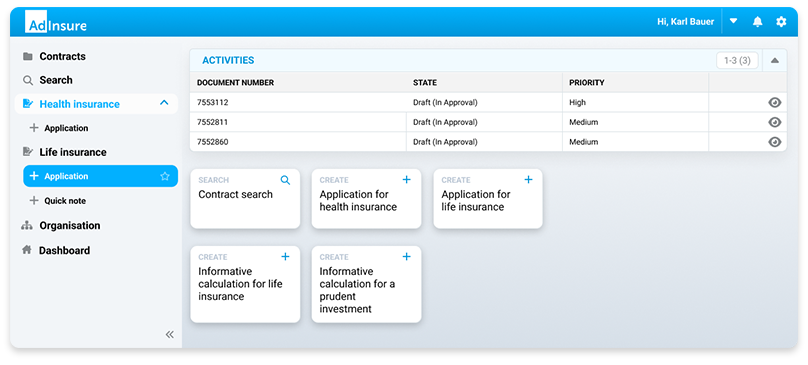

Adacta delivered a stand-alone agent B2B Sales Portal, powered by Adinsure.

The solution featured:

- A Unified and Scalable Platform: Enables seamless operations across all banking channels, ensuring consistent processes and scalability for future expansion.

- Fully Digitalized and Standardized Bancassurance Sales Process: The solution automates key workflows, from proposal generation to policy issuance.

- Support for Multiple Insurance Products including Life Insurance with Partial Premium Reimbursement and Investment Insurance.

Project results

Adacta’s solution significantly streamlined client’s bancassurance sales channels by delivering:

- Integrated Risk Analysis: The Munich RE risk analysis questionnaires ensure accurate underwriting and seamless risk management.

- Scalable and Cloud-Based Deployment: The portal is deployed on Microsoft Azure, ensuring flexibility, scalability, and performance for future growth.

- Sales Performance Support: Embedding insurance offers into the loan process provides crossselling opportunities for partner banks.

- Enhanced User Experience: The intuitive user interface simplifies processes from offer creation and customization to premium calculations.