Claims handling

The Claims handling functionality provides end-to-end support to insurers’ claims department needs, allowing claim teams to manage everything from claim intake and reserving to underwriting and payment.

Book a demo DOWNLOAD FLYERFlexible and Integrated Claims handling

Our claims handling system is built on a flexible workflow, intuitive dashboards, and role-based access. The web-based architecture allows seamless integration with external service providers, making it easy to extend functionality or build specialized claims service platforms. Whether integrating with front-end portals or streamlining partner collaboration, our system ensures a smooth and efficient process.

The Claims handling module is natively integrated with the Policy Management, Recoveries, Reinsurance, Accounting and Complaints Management & Legal Disputes modules.

With modular flexibility and strong interoperability, our solution adapts to evolving business needs while maintaining compliance and operational efficiency.

Key features

First notice of loss

Collect the initial data on a claim over a back-office UI or over portals and API integration. Use a configurable set of rules to assign and streamline further handling of a claim.

Claim assignment

Automate assignments with configurable business rules considering line of business, claims complexity, geography, and the use of smart activity schedules based on workloads.

Reserves

Automate the setting of reserves and change reserves manually. Calculate reserves dynamically based on business rules and manage reserve type, currency, and amounts.

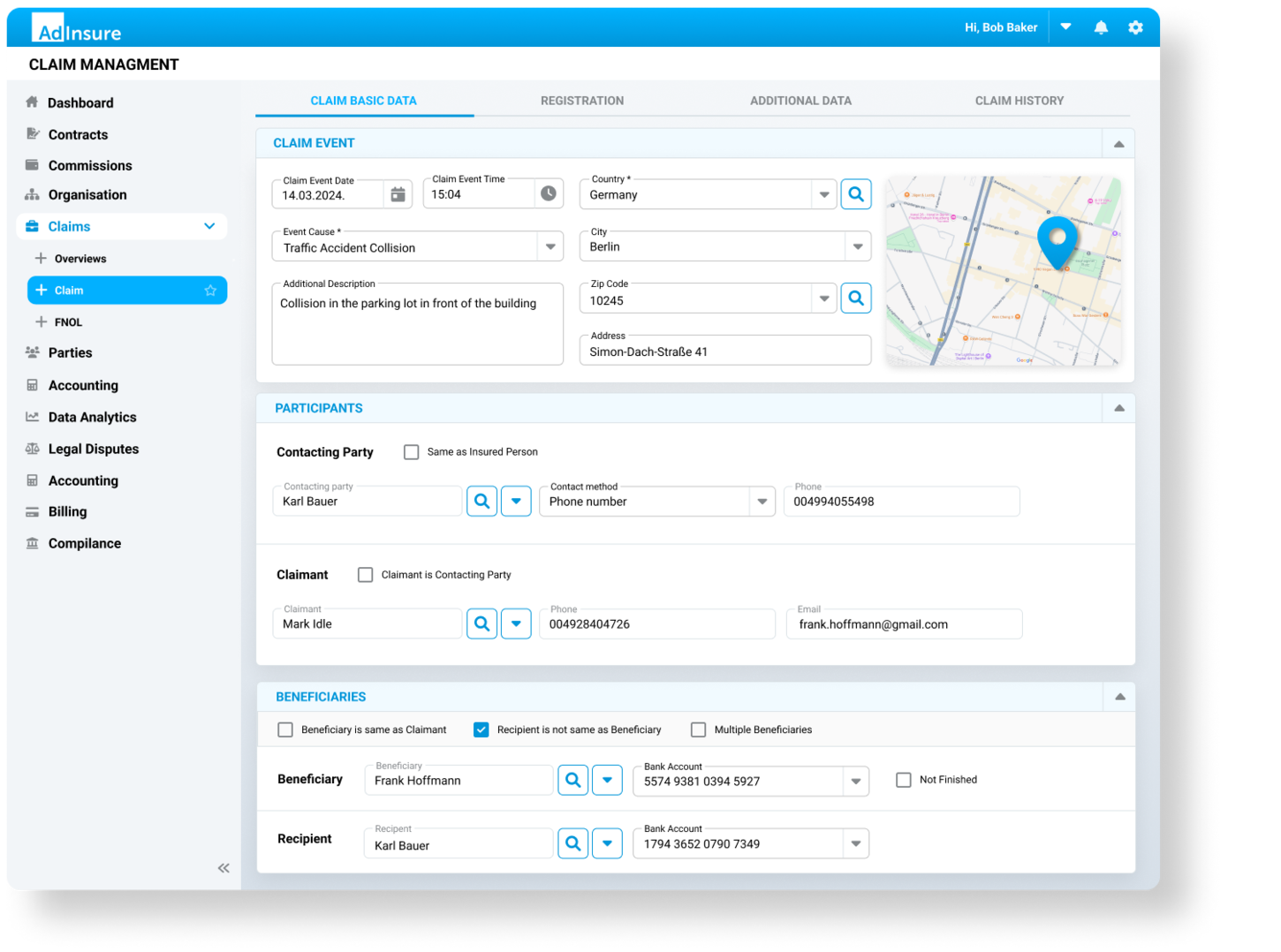

Claim registration

Claim registration is based on FNOL or directly entered related data, including policy, claimant, claim event, insured and damaged object, coverage, participants, document attachments.

Claim underwriting

Define underwriting rules and automatically trigger the process during claims settlement and confirming claim pay-outs. Manage underwriting levels and roles.

Claim liquidation

Use a predefined business process that supports multiple levels of claims underwriting, post information to the Accounting module, and create payment orders automatically.

Service claims

Pay out claims on behalf of a partner company and leverage support for both passive and active service claims (both sides of the partner agreement).

Catastrophic event management

Manage multiple claims linked to a single or multiple claim events with one or more claim causes (natural disaster).

Payments

Create payments for claim calculation items, including split and multi-party payments. Ensure accounting evidence of all claims transactions, easily integrated with the General Ledger

Partner management

Handle all information, interactions, and compliance-related data for parties and service partners involved in claims. Employ a 360-degree view of data, status of claims, and financial records.