Transform your commercial insurance

Insurers across different commercial lines use AdInsure plaform to digitalize their products and redesign their underwriting processes. Some transform their business with AdInsure for Commercial insurance. Others rely on AdInsure Underwriter Workbench to integrate their new underwriting process with existing systems. End-to-end or standalone – which solution is the best fit for your business?

BOOK A DEMO

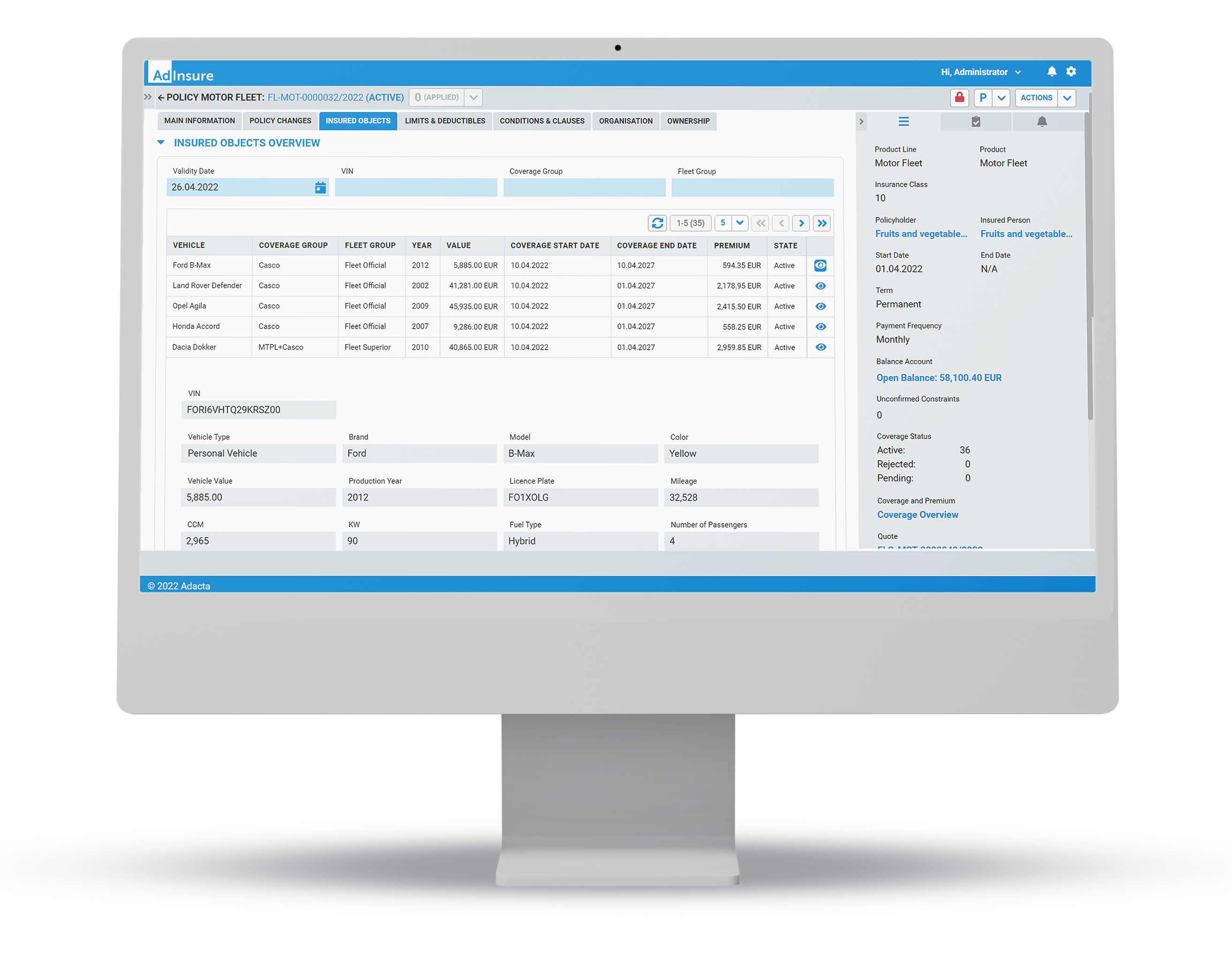

An end-to-end solution for your commercial lines

AdInsure provides support for a wide range of commercial products, even the most complex ones.

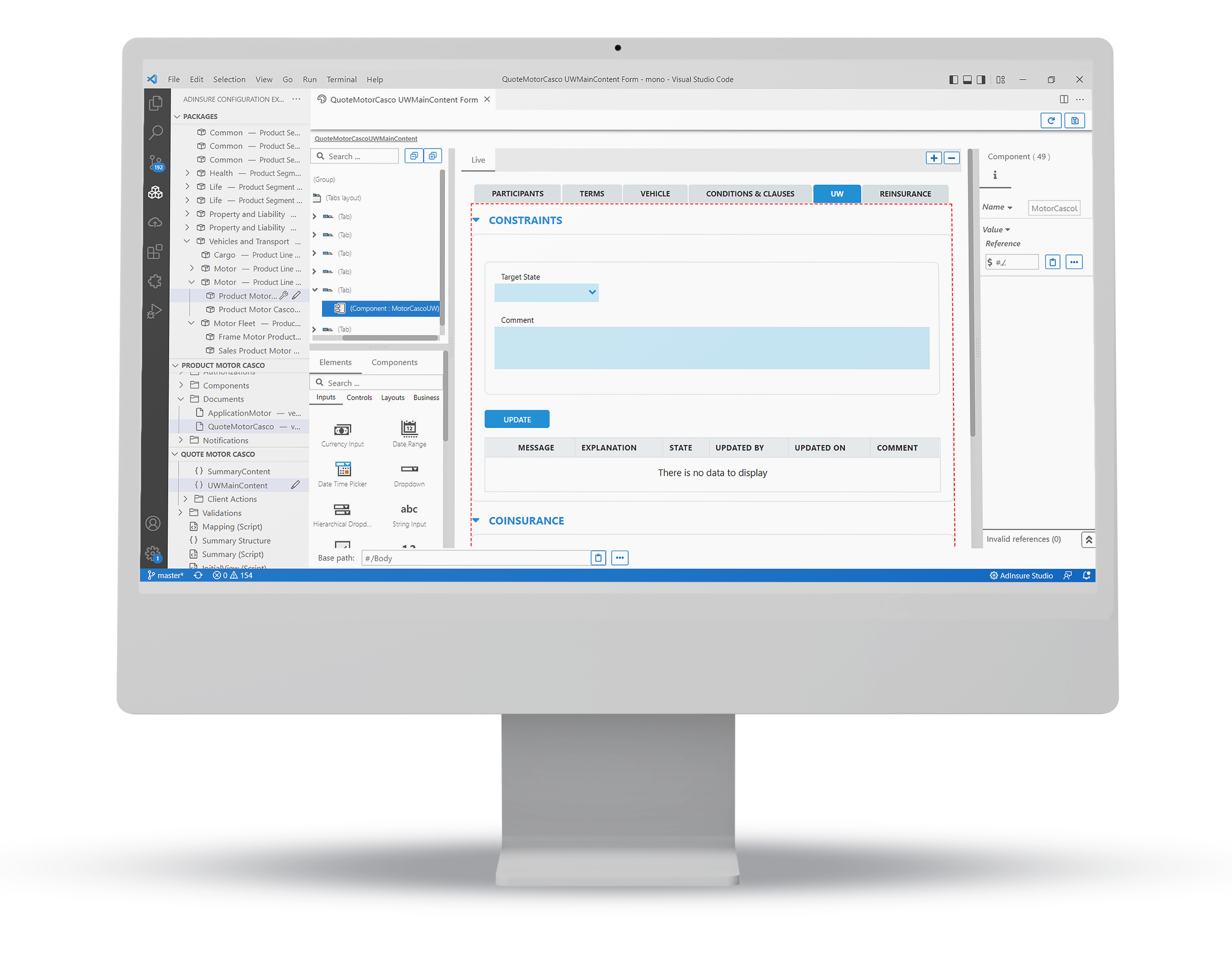

Take control of your digital strategy with AdInsure`s extensive functionality built specifically for commercial insurers: support for commercial lines products, sales and underwriting portals, back-office functionality, fully digitalized underwriting, low-code configuration tools, built-in compliance, and more.

Underwriting workbench for non-life insurance

AdInsure Underwriting Workbench is a unified hub for underwriters, consolidating risk and data, activities, and documentation. It streamlines the management of new business, renewals, and endorsements in one centralized location.

- Underwriters Dashboard

- Case & Opportunity management

- Risk management

- Clause management

- Capacity management

- An open integration interface

A digital underwriting experience

Frequently asked questions

For a fast overview, here are some of the most asked questions we get about AdInsure's support for commercial lines insurance.

Which commercial lines of business AdInsure supports?

We designed AdInsure to support any kind of insurance products. Out of the box, we provide more support for commercial lines run in production by our Clients and the list grows daily. Currently, our Clients run the following lines in production: Commercial Auto and Fleet, Commercial Property Liability, Commercial General Liability, Goods-In-Transit, Agriculture, Wholesale, Construction, Manufacturing, All-risk, Specialty lines, International programs.

How does AdInsure support the underwriting process in commercial non-life insurance?

With AdInsure, the underwriting process can be adjusted for each line of business or even for each insurance product separately. Underwriting automation is supported by AdInsure business rules, workflows, and 3rd party integration. Underwriters can also assign tasks and collaborate with agents via Video chat. AdInsure is on the mission to support underwriters to focus on high-value activities and make better, faster, and more accurate decisions.

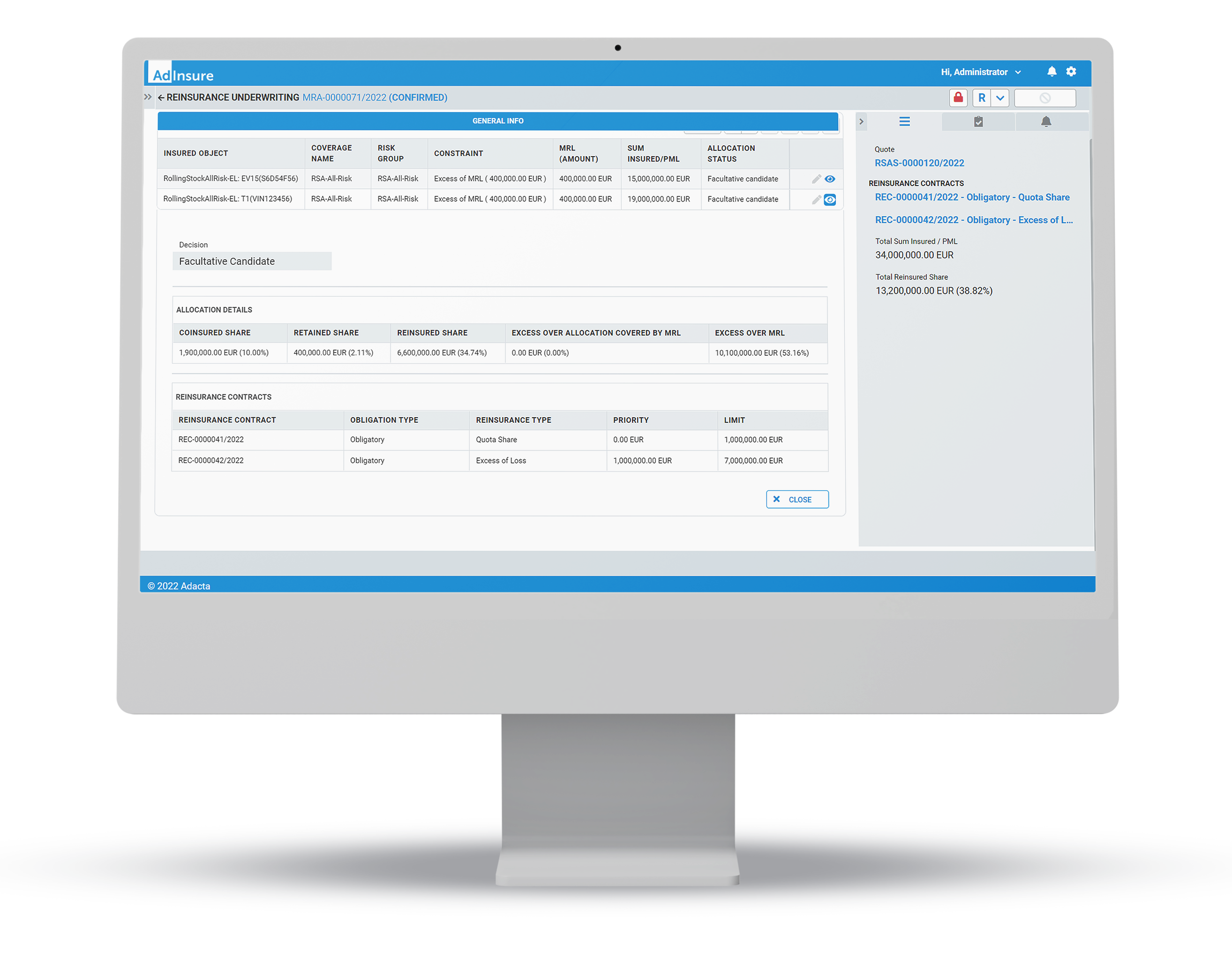

Is there additional integration required for claims and reinsurance functionality?

No additional integration is necessary; AdInsure is an integrated system in which all business modules are integrated natively. Based on the configuration of products, the policy, claims, and reinsurance modules, know how to "talk to each other" out of the box. the Claims module can obtain all the necessary data to process the claim from other sources automatically.

What tools are available to support sales?

The AdInsure Sales Portal provides everything a sales agent needs in one place, from workflows for applications, quotes, policies, underwriting. Even custom dashboards that provide features such as an overview of open invoices and commissions. The portal also enables the agent to collaborate with the team or clients with co-browsing and video functionality. The "mini CRM" functionality provides a 360 client view- overview of all the offers, policies, personal and billing information, even consensus, all in one place.

Why commercial insurers choose AdInsure?

The comprehensive functionalities of AdInsure support all your teams, for any commercial product and process, and provide significant savings in infrastructure, effort, knowledge building and maintenance. New products are automatically exposed via API with no need for customization, which significantly reduces the time required to bring new products to the market. AdInsure tools, wizards, and libraries of predefined packages provide insurers with flexibility and control over cost and time while rolling out new offerings.

Does AdInsure support commercial underwriting automation?

Yes. The process can be automated to a large degree thanks to the workflow and business rules capabilities. Automation includes automated generation of constraints (based on configured business rules), confirmation or rejection of quotes, assessment of risk based on 3rd party data and more.