AdInsure Claims

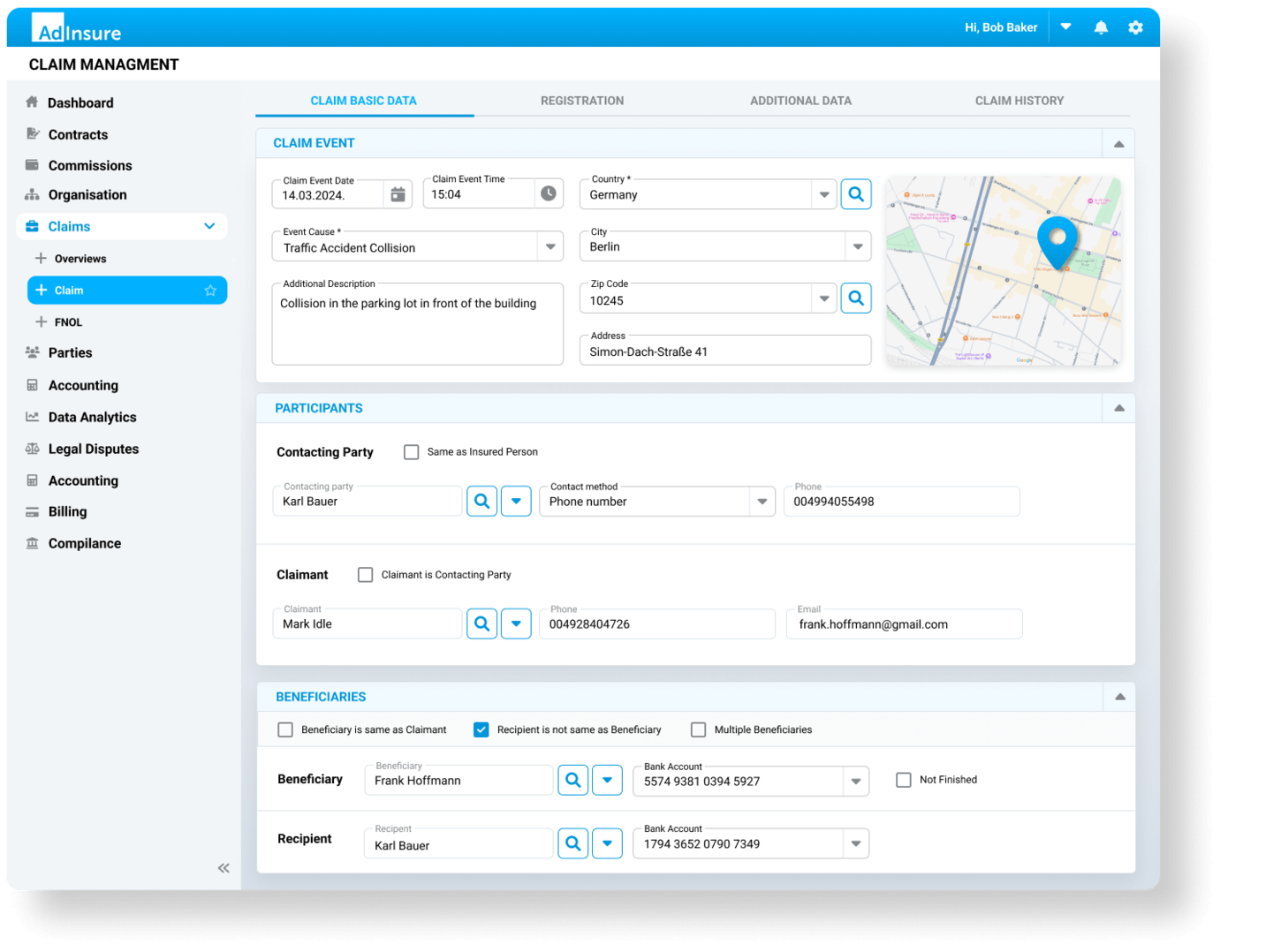

AdInsure Claims is a comprehensive, end-to-end insurance claims management solution designed to optimize the entire claims lifecycle—from First Notice of Loss (FNOL) to settlement, including recoveries and reinsurance. Advanced automation and configurable workflows enhance efficiency, reduce operational costs, exceed customer expectations, and empower insurers to make data-driven decisions across all P&C lines of business.

Watch the video Talk to salesHolistic claims management solution

In today’s insurance landscape, claims leaders face increasing pressure to streamline claims management process, reduce cycle times, and improve customer satisfaction—all while navigating complex regulatory requirements and minimizing operational costs. Many insurance companies are stuck relying on fragmented systems that lead to inefficiencies, delays, and a lack of actionable insights. With AdInsure Claims, claims managers gain a single, comprehensive insurance claims management solution to address these challenges head-on.

Accelerate claims processing and shorten cycle times

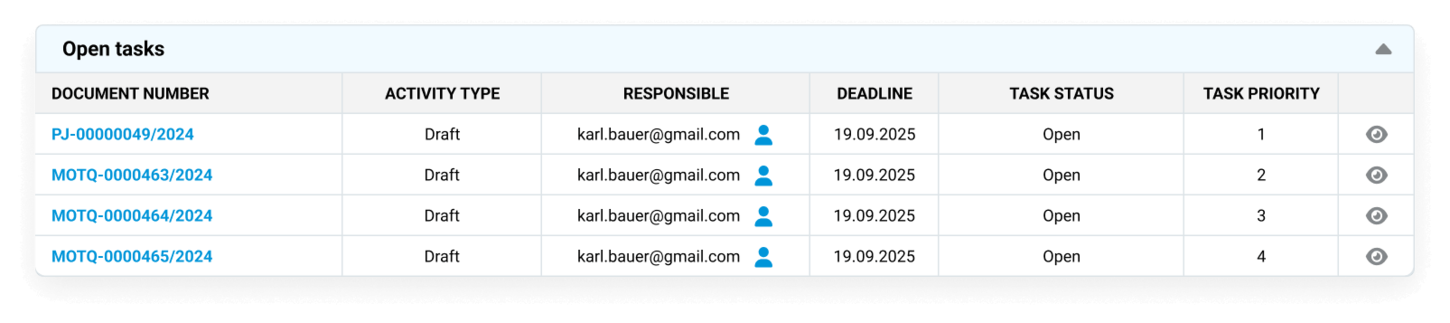

Automate activities like claim assignment, underwriting and liquidation to accelerate cycle times, reduce workloads, and allow your team to focus on high-impact tasks.

Make smarter decisions with data-driven insights

Get a 360° view of claims, track SLAs, and monitor performance to optimize decisions. Use predictive insights to assess complexity and route cases efficiently, boosting resolution speed.

Reduce costs with streamlined operations

Integrate reinsurance, legal procedures, and recoveries into a unified solution, eliminating inefficiencies and minimizing unnecessary overhead.

Fragmented processes create claims inefficiencies

Every insurance company often faces inefficiencies when managing the complex claims lifecycle due to disconnected systems and manual processes. These challenges lead to prolonged cycle times, operational bottlenecks, and decreasing customer satisfaction. The lack of a unified solution to oversee FNOL, reserves, settlements, and recoveries exacerbates delays, increases costs, and hampers overall performance.

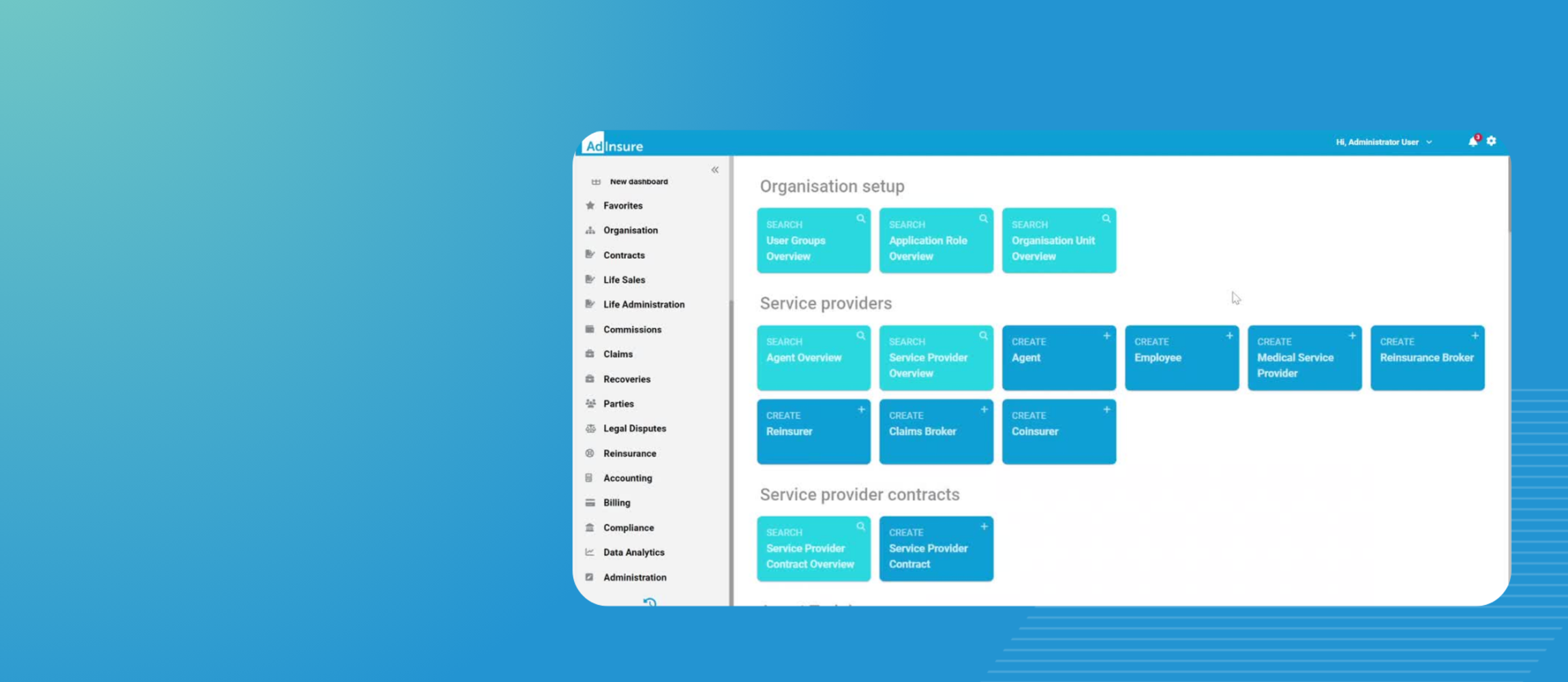

Effective claims management solution to simplify the entire lifecycle

AdInsure Claims streamlines workflows for faster settlements, smarter tracking, and seamless collaboration. Enhance efficiency, improve customer experiences, and optimize resources—all in one solution.

Reporting

Document management

Handler/manager portal

Fraud

management

Recoveries

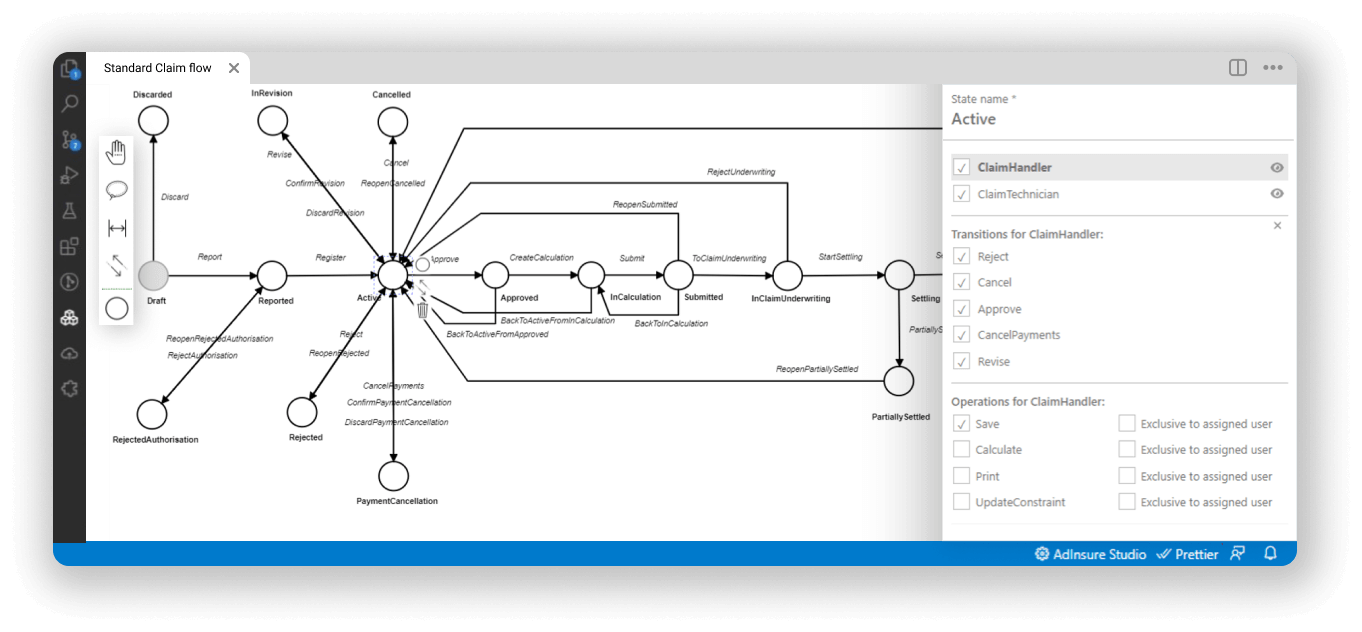

Easily configure claims processes to fit your business

AdInsure’s claims configuration capabilities empower insurers to tailor every aspect of their claims operations. Insurers can easily adapt claims processes, automate decision-making, and enforce business rules to improve efficiency and accuracy.

With built-in ease of integration, AdInsure seamlessly connects with external data sources and third-party services, enhancing the overall claims management process.